Foral Decree 22/2023, published in the Official Gazette of the Historical Territory of Alava on June 7, 2023, has approved the modification of Foral Decree 40/2014, which regulates Personal Income Tax, and Foral Decree 4/2023, which establishes the rules for the special simplified Value Added Tax regime for the year 2023. This regulation introduces into… Continue reading Tax advisor: Alava makes changes to its Personal Income Tax regulations

Tag: Spain

Tax advisor: Rejected the consultation for inflation to be deducted from the real estate gain in the Personal Income Tax

The Constitutional Court has issued a ruling rejecting the deduction of inflation from real estate gains in the Personal Income Tax (IRPF). With this, it upholds the 2014 reform that eliminated the corrective coefficients that reduced the tax payable based on inflation. The ruling resolves the question of unconstitutionality raised by the High Court of… Continue reading Tax advisor: Rejected the consultation for inflation to be deducted from the real estate gain in the Personal Income Tax

Tax advisor: It is obligatory to declare when only a foreign pension is received

When the total income derived from work comes from a single payer, the limit for determining the obligation to file a tax return is set at 22,000 euros per year (according to article 96.2.a) and 3) of the IRPF Law). However, this limit does not apply in principle to taxpayers who receive earned income from… Continue reading Tax advisor: It is obligatory to declare when only a foreign pension is received

Tax advisor: Modified Bizkaia’s regulations on the Fluorinated Greenhouse Gas Tax to simplify obligations and control of the tax

The Normative Foral Decree 2/2023, published in the Official Gazette of Bizkaia on May 25, 2023, introduces amendments to the Foral Regulation 5/2014, on the Tax on Fluorinated Greenhouse Gases. This regulation incorporates the amendments made at the national level by Law 14/2022, which amends Law 16/2013, related to environmental tax measures and other tax… Continue reading Tax advisor: Modified Bizkaia’s regulations on the Fluorinated Greenhouse Gas Tax to simplify obligations and control of the tax

Tax advisor: Lower taxation in Economic Activities Tax for the hostelry due to closures during the pandemic

According to two rulings of the Supreme Court, issued on May 30 and recently disclosed, hotel and restaurant businesses have the right to decrease the amount of Economic Activities Tax (IAE) corresponding to the period in which they had to close due to the coronavirus pandemic. These rulings establish that municipalities must proportionally reduce the… Continue reading Tax advisor: Lower taxation in Economic Activities Tax for the hostelry due to closures during the pandemic

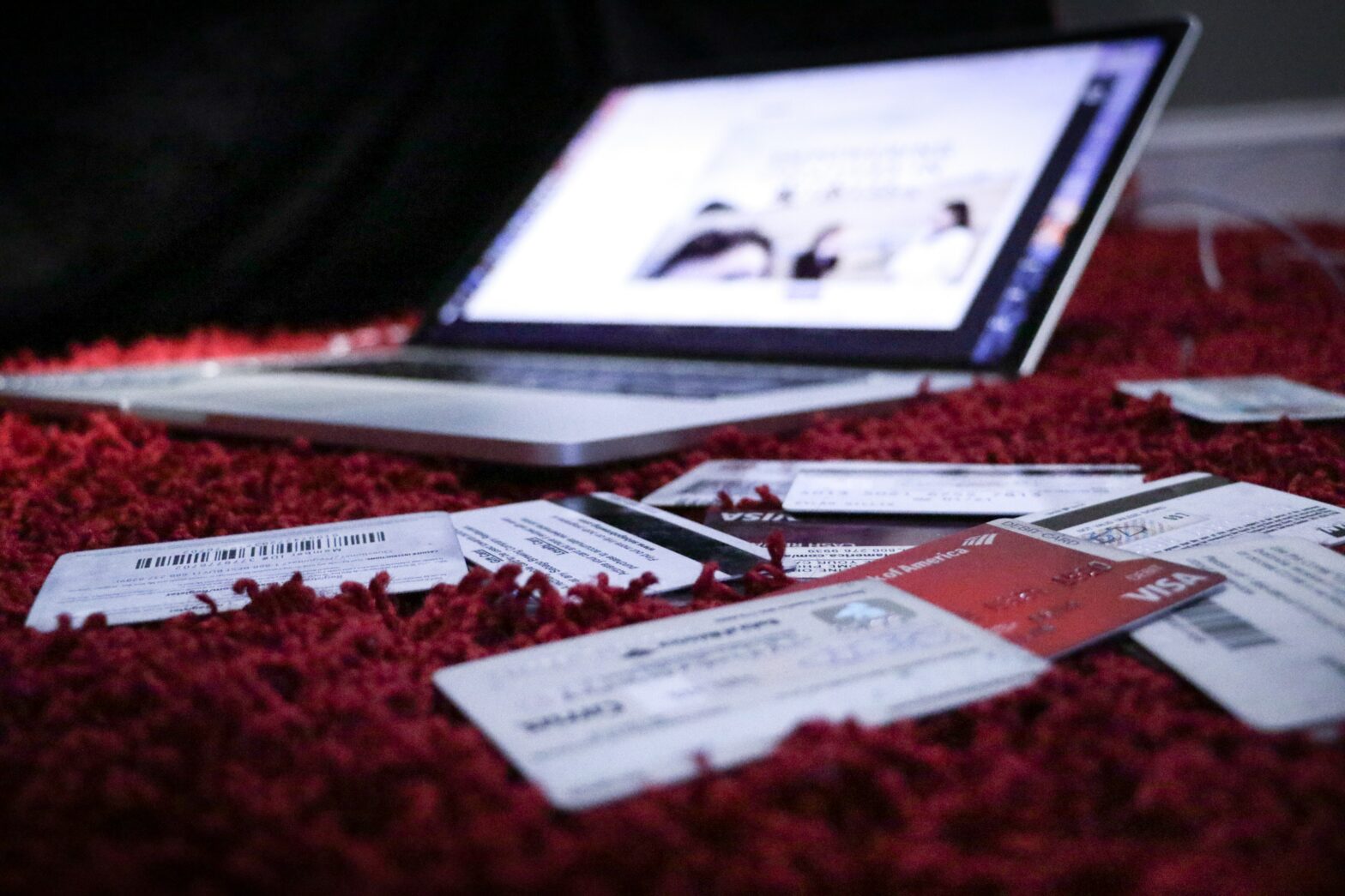

Tax Advisor: Taxation of Deposits and Savings Accounts

Banks now pay interest on customer savings due to rising interest rates. Deposits and savings accounts generate interest to take advantage of the money saved. Deposits involve leaving money in the bank for a certain period of time in exchange for interest, while savings accounts allow customers to access their money whenever they wish. This… Continue reading Tax Advisor: Taxation of Deposits and Savings Accounts

Tax advisor: What does collaboration with the Tax Administration mean and the consequences of non-compliance

In 2003, the General Tax Law was passed, which emphasized the breach of the duty to provide information to the Tax Administration, giving rise to the current article 203 of the LGT and the corresponding penalties. In the old law, resistance or obstruction was considered an aggravating factor in the grading of penalties and only… Continue reading Tax advisor: What does collaboration with the Tax Administration mean and the consequences of non-compliance

Tax advisor: New reductions in the Personal Income Tax related to the rental of housing

Last May 25, Law 12/2023, which includes tax measures related to rental housing, was published in the Official Gazette. As from January 1, 2024, the percentages of reduction of the positive net yield derived from the rental of housing are modified. The new reductions are as follows: 90% reduction if the following is met: –… Continue reading Tax advisor: New reductions in the Personal Income Tax related to the rental of housing

Tax advisor: TEAC exempts taxpayer from paying tax on past interest on late payment of taxes

In two recent rulings, the Central Economic-Administrative Court (TEAC) has protected taxpayers who could face a tax regularization due to a recent Supreme Court ruling on the taxation of late payment interest. Specifically, this agency, which is part of the Ministry of Finance and Public Function, has determined that the tax authority cannot take advantage… Continue reading Tax advisor: TEAC exempts taxpayer from paying tax on past interest on late payment of taxes

Tax advisor: New procedure for the submission of the communication of art. 48 RIS in relation to restructuring operations

In order to simplify the filing of the communication required in article 48 of the Corporate Income Tax Regulation (RIS) for certain restructuring operations, a specific filing procedure is established in the digital platform of the State Agency of Tax Administration. It is recalled that Article 48 of Royal Decree 634/2015, of July 10, which… Continue reading Tax advisor: New procedure for the submission of the communication of art. 48 RIS in relation to restructuring operations