The General Directorate of Taxes (DGT), an entity attached to the Ministry of Finance and Public Function, with the primary function of establishing the criteria for the application of various taxes, including Personal Income Tax (IRPF), has recently issued relevant pronouncements. In this regard, in the case of a taxpayer who telecommutes from a foreign… Continue reading Taxation of digital nomads

Tag: Digital Nomads

Admission of displaced self-employed individuals to the Beckham Law: requirements and procedures

I. Eligibility requirements: Absence of previous residency in Spain: pursuant to current regulations, it is stipulated as a fundamental requirement for admission to the special regime of the Beckham Law for displaced self-employed individuals that the applicant has not been a tax resident in Spain in the five years preceding the displacement that prompts the… Continue reading Admission of displaced self-employed individuals to the Beckham Law: requirements and procedures

Tax Advisor: How is the Beckham Law applied?

“The Beckham Law” refers to the special tax regime for foreign workers who establish their tax residence in Spain. Officially known as Decree Law 687/2005, this regime is named after the famous British footballer David Beckham, who was one of the first to benefit from its provisions when he moved to Real Madrid in 2003. … Continue reading Tax Advisor: How is the Beckham Law applied?

The donation of shares

The donation of shares can be a valuable instrument in the context of corporate reorganization, allowing entrepreneurs to plan generational succession and transfer control of the company to their heirs or other family members. In this article, the most significant aspects of the donation of shares are examined from a corporate perspective. Capacity and… Continue reading The donation of shares

Digital nomads and other collectives arriving in 2022 and 2023 will be able to retroactively apply for the ‘Beckham Law’.

On December 7, 2023, Royal Decree 1008/2023, of December 5, 2023, which amends the Personal Income Tax Regulations, came into force. Among the main modifications, the adaptation of the “Beckham Law” application procedure stands out, for those new groups that want to apply to the regime as a result of the modifications of the Personal… Continue reading Digital nomads and other collectives arriving in 2022 and 2023 will be able to retroactively apply for the ‘Beckham Law’.

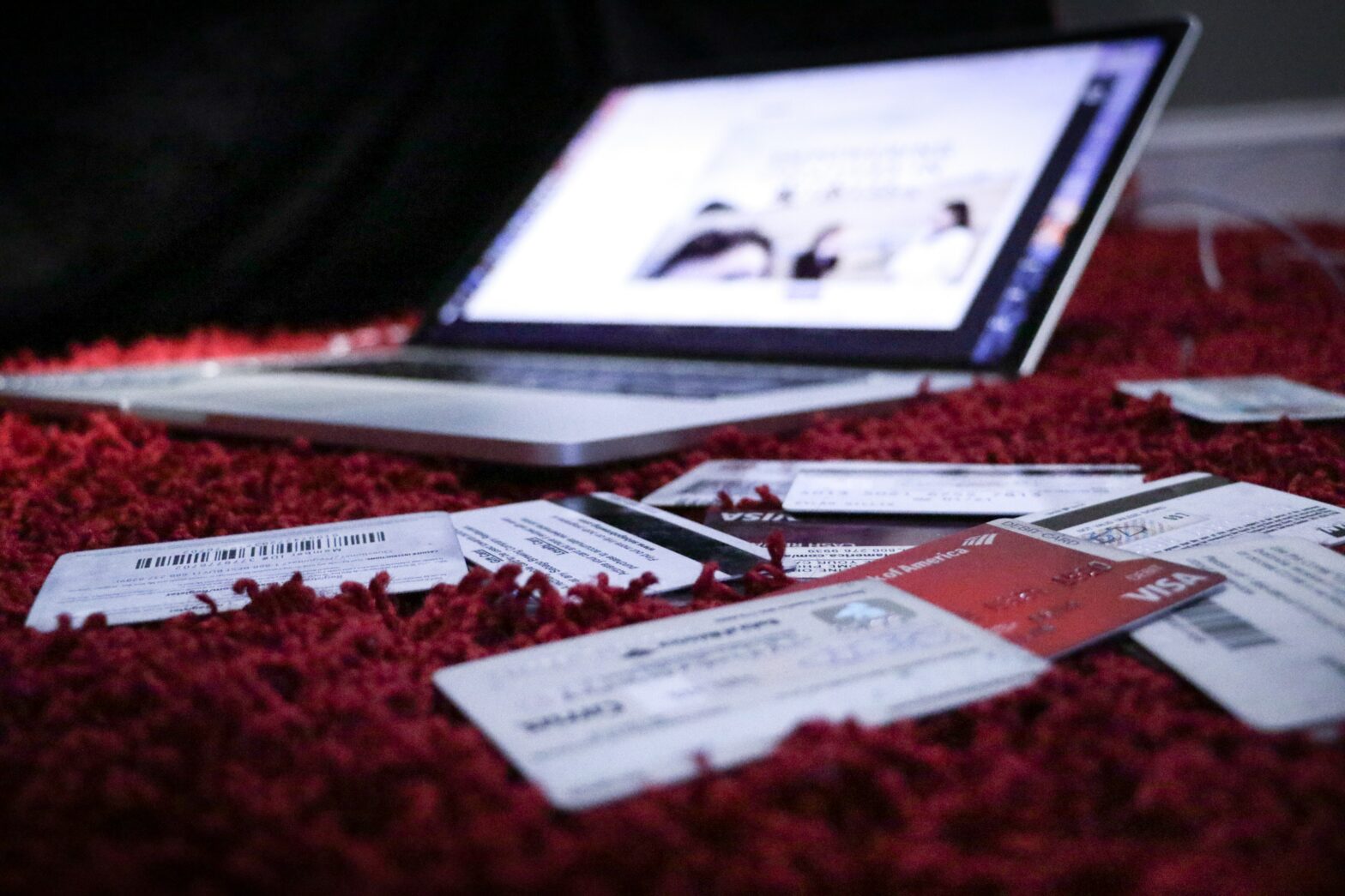

Tax Advisor: Digital Nomads in Spain: Challenges and opportunities in a globalized world

The presence of Digital Nomads in Spain has been essential for the modernization of the labor market , providing workers with complete freedom and companies with the ability to recruit global talent. However, these promises are affected by labor and tax complexities that vary depending on the type of employment and location. According to the… Continue reading Tax Advisor: Digital Nomads in Spain: Challenges and opportunities in a globalized world

Tax Advisor: Spain as a Top Destination for Digital Nomads: Unraveling the Emerging Business Law

Spain advances in the ranking of the most attractive places for digital nomads after this modification in the regulations, as a result of the recent approval of the law promoting the development of the emerging business ecosystem (Law 28/2022, of December 21) or Startup Law. The changes and advantages introduced in the new regulation of… Continue reading Tax Advisor: Spain as a Top Destination for Digital Nomads: Unraveling the Emerging Business Law