The ruling that has been appealed to the Supreme Court confirmed the Administration’s position on the non-exemption of income under article 121.1 of the Corporate Tax Act. It relied on the doctrine established in the Supreme Court ruling of November 29th, 2016, in appeal number 3973/2015. On the issue of the deduction of the expense… Continue reading Tax Advisor: Are SGAE contributions to funds for the promotion of complementary activities from copyright income deductible for Corporate Tax purposes?

Tag: Europe

Tax Advisor: Appeals of unconstitutionality against the Law on the ITSGF have been admitted for processing

The Constitutional Court has admitted the appeals of unconstitutionality against the Law on the Temporary Solidarity Tax on Large Fortunes, filed by the autonomous governments of Madrid and Galicia. Likewise, the deny of the suspension of the challenged regulation requested by the Community of Madrid has been agreed. The Governing Council of the Community of… Continue reading Tax Advisor: Appeals of unconstitutionality against the Law on the ITSGF have been admitted for processing

Tax advisor: Is it possible for the management body to use the direct estimation even if it is not appropriate for calculating the Personal Income taxable base?

Article 136.2.c) of the General Tax Law allows the management bodies to examine records, documents and any other official book or document, excluding commercial accounting. The examination of these accounts is not permitted, but the documents supporting the transactions recorded or declared by the taxpayer may be examined. The review of commercial accounting within the… Continue reading Tax advisor: Is it possible for the management body to use the direct estimation even if it is not appropriate for calculating the Personal Income taxable base?

Tax advisor: When is a marketing expense on promotion considered not to be a liberality in terms of Corporate Tax?

The Supreme Court Ruling, of March 30th, 2021, appeal no. 3454/2019, determined that booked expenses are not deductible if they constitute donations or liberalities. However, accounted expenses incurred for public relations with customers or suppliers, those incurred to promote the sale of goods or services, those that respond to the same business structure and are… Continue reading Tax advisor: When is a marketing expense on promotion considered not to be a liberality in terms of Corporate Tax?

Tax advisor: Does the exclusion of the computation of the period between March 14 and June 1, 2020 automatically operate to determine the maximum duration of the different tax proceedings?

In the situation that emerges from the Supreme Court Order, of March 22nd, 2023, the heirs of a deceased person filed and contentious-administrative appeal against the exclusion of the period between March 14 and June 1, 2020 from the maximum duration of the limited verification procedure. They argued that the tax administration should have justified… Continue reading Tax advisor: Does the exclusion of the computation of the period between March 14 and June 1, 2020 automatically operate to determine the maximum duration of the different tax proceedings?

Tax advisor: Can the assessment issued in an inspection procedure that was based on the same data and evidence used in a limited verification process already expired be annulled?

The Superior Court of Justice of Madrid has ruled on the issue in question. It examines the consequence of a limited verification procedure that expired without an express declaration of expiration. The objective is to determine whether the State Tax Inspectorate was authorized to carry out verification and investigation actions in relation to the 2014… Continue reading Tax advisor: Can the assessment issued in an inspection procedure that was based on the same data and evidence used in a limited verification process already expired be annulled?

Tax advisor: Increasing tax debt payment facilities

In the current context of inflation and rising interest rates, many companies and individuals are struggling with their payment obligations. For this reason, the Tax Agency has increased the payment facilities for tax debts, making deferrals more flexible and thus facilitating taxpayers’ liquidity. The guarantee exemption limit for the deferral of tax debts has been… Continue reading Tax advisor: Increasing tax debt payment facilities

Tax advisor: The previous Corporate Tax Act already allowed the partial non-application of the FEAC regime.

A DGT report clarifies that the previous Corporate Tax Act already allowed the partial non-application of the FEAC regime (regime for mergers, spin-offs, non-monetary contributions and exchange of securities). This previous law was not at all precise on this aspect, and its literal interpretation could lead to the conclusion that, if there was no legitimate… Continue reading Tax advisor: The previous Corporate Tax Act already allowed the partial non-application of the FEAC regime.

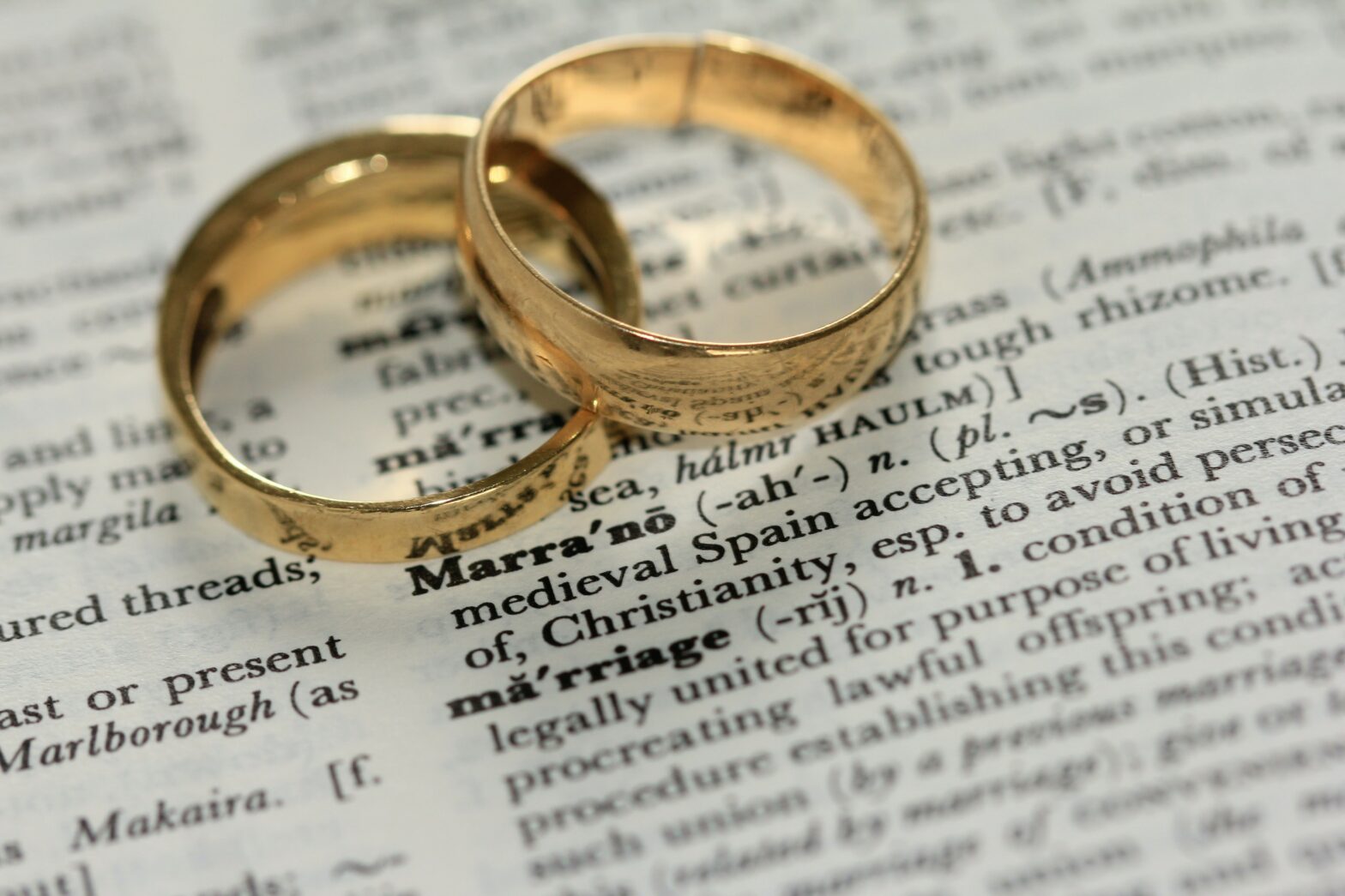

Tax advisor: What personal changes must the taxpayer notify in the Income Tax Return?

For a taxpayer who wishes to apply deductions or reductions in the Income Tax Return, it is of vital importance to collect all the income obtained, but also all the personal data that may have changed in the last year. Personal changes to notify in the Personal Income Tax Return – Change of address: many… Continue reading Tax advisor: What personal changes must the taxpayer notify in the Income Tax Return?

Tax Advisor: Corporate Tax Deductions for R&D&I Projects

When an investment is made or expenses are incurred for the purpose of developing the economic activity of a company, there may be deductions in the amount of tax payable. That is why there are tax deductions in the Corporate Tax for R&D&I projects. The tax deduction can be seen as an indirect form of… Continue reading Tax Advisor: Corporate Tax Deductions for R&D&I Projects