The Superior Court of Justice of Andalusia ruled on November 22nd, 2022 in relation to deductible expenses in accounting. All as a result of a specific case: an appellant filed a certificate to rectify her request for rectification of her 2015 corporate income tax self-assessment to vary the profit and loss result. She attributed this… Continue reading Tax advisor: Inappropriateness in the modification of the accounting approved at the time by the Mercantile Register

Tag: investment

Tax advisor: Rental housing and rehabilitation deductions in the 2022 Personal Income Tax return

Housing has always played a very important role in the Personal Income Tax return. Its deduction can be given due to the mortgage of the purchase, although this benefits less and less taxpayers and refers only to houses acquired before 2013. However, this year there are certain new features. Deductions for energy improvement works of… Continue reading Tax advisor: Rental housing and rehabilitation deductions in the 2022 Personal Income Tax return

Tax Advisor: Flexibility of the Tax Agency in deferrals to facilitate the taxpayer’s liquidity

The BOE publishes Order HFP/311/2023, dated March 28th, with effect from April 15th, thus including two instructions: – Instruction 1/2023, of the Director of the Collection Department of the State Tax Agency, specifying the guarantees required to grant payment deferrals and to suspend administrative acts. – Instruction 2/2023, of the Director of the Collection Department… Continue reading Tax Advisor: Flexibility of the Tax Agency in deferrals to facilitate the taxpayer’s liquidity

Tax advisor: Variables in the Personal Income Tax return according to family situation

As it is usual, there are a series of variables in the Personal Income Tax return according to the family situation. The citizen must know them in order to know which new regulations can be applied in order to benefit from certain deductions. Main family deductions – For maternity, for those mothers in labor situation… Continue reading Tax advisor: Variables in the Personal Income Tax return according to family situation

Tax advisor: Form 511 and delivery notes for diesel oil at reduced rates

The Tax Agency has published Form 511, for the telematic filing of delivery notes of diesel oil at reduced rate that have been issued through the en route sales procedure, within the scope of Excise Duties. The modification, in turn, is contained in Royal Decree 1075/2017. It specifies that final consumers of subsidized diesel will… Continue reading Tax advisor: Form 511 and delivery notes for diesel oil at reduced rates

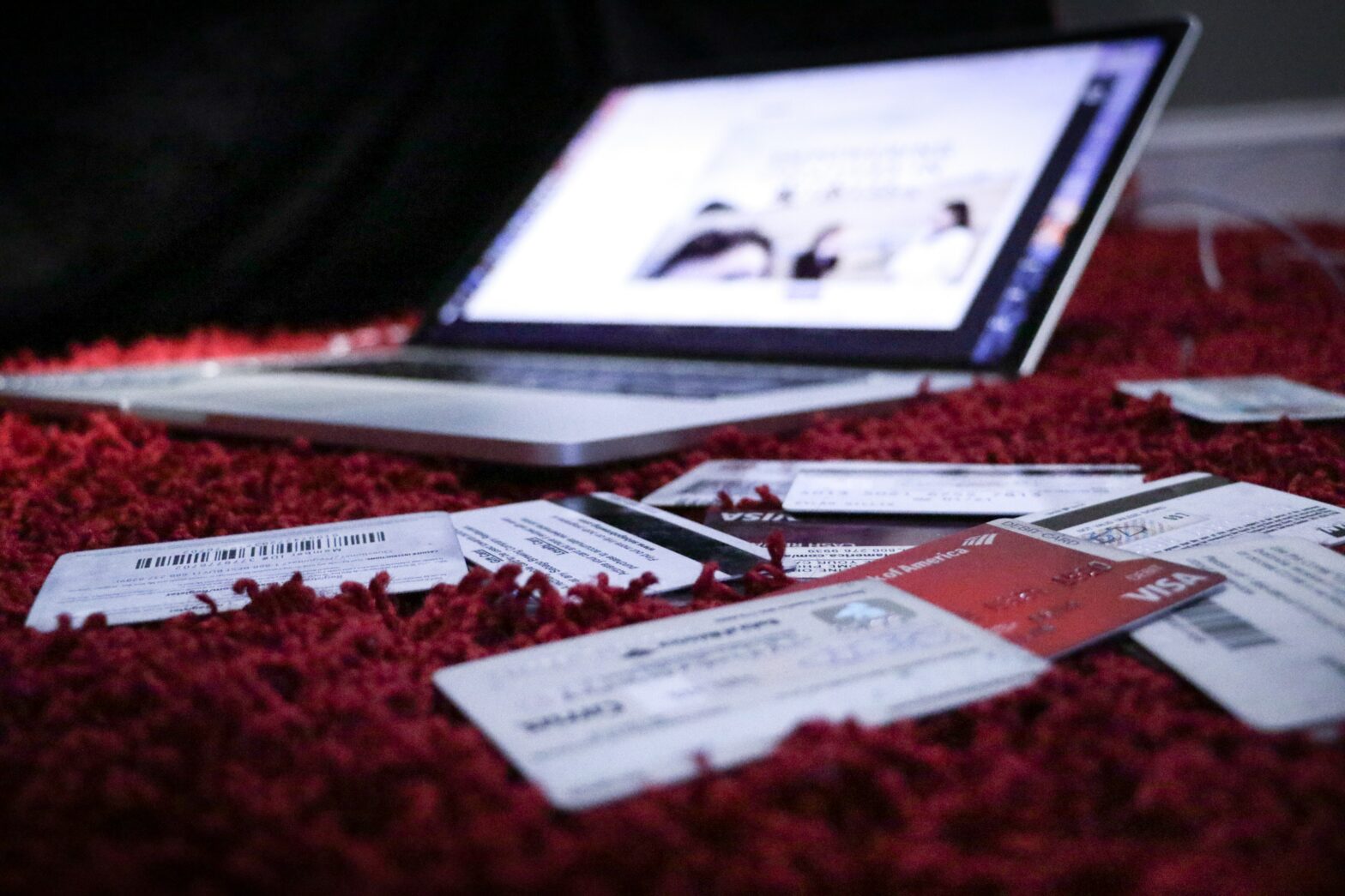

Tax advisor: Reduce taxation with investment losses in the 2022 Personal Income Tax return

In the following lines we will explain how to pay less to Hacienda with investment losses in the 2022 tax return. Last year’s data show that both European equity and fixed income funds lost between 8 and 10%. However, this bad data may serve to offset this year’s tax bill from investments, both in the… Continue reading Tax advisor: Reduce taxation with investment losses in the 2022 Personal Income Tax return