The Supreme Court Ruling, of March 30th, 2021, appeal no. 3454/2019, determined that booked expenses are not deductible if they constitute donations or liberalities. However, accounted expenses incurred for public relations with customers or suppliers, those incurred to promote the sale of goods or services, those that respond to the same business structure and are… Continue reading Tax advisor: When is a marketing expense on promotion considered not to be a liberality in terms of Corporate Tax?

Tag: termination of activity

Tax advisor: Does the exclusion of the computation of the period between March 14 and June 1, 2020 automatically operate to determine the maximum duration of the different tax proceedings?

In the situation that emerges from the Supreme Court Order, of March 22nd, 2023, the heirs of a deceased person filed and contentious-administrative appeal against the exclusion of the period between March 14 and June 1, 2020 from the maximum duration of the limited verification procedure. They argued that the tax administration should have justified… Continue reading Tax advisor: Does the exclusion of the computation of the period between March 14 and June 1, 2020 automatically operate to determine the maximum duration of the different tax proceedings?

Tax advisor: Can the assessment issued in an inspection procedure that was based on the same data and evidence used in a limited verification process already expired be annulled?

The Superior Court of Justice of Madrid has ruled on the issue in question. It examines the consequence of a limited verification procedure that expired without an express declaration of expiration. The objective is to determine whether the State Tax Inspectorate was authorized to carry out verification and investigation actions in relation to the 2014… Continue reading Tax advisor: Can the assessment issued in an inspection procedure that was based on the same data and evidence used in a limited verification process already expired be annulled?

Tax advisor: Increasing tax debt payment facilities

In the current context of inflation and rising interest rates, many companies and individuals are struggling with their payment obligations. For this reason, the Tax Agency has increased the payment facilities for tax debts, making deferrals more flexible and thus facilitating taxpayers’ liquidity. The guarantee exemption limit for the deferral of tax debts has been… Continue reading Tax advisor: Increasing tax debt payment facilities

Tax advisor: The previous Corporate Tax Act already allowed the partial non-application of the FEAC regime.

A DGT report clarifies that the previous Corporate Tax Act already allowed the partial non-application of the FEAC regime (regime for mergers, spin-offs, non-monetary contributions and exchange of securities). This previous law was not at all precise on this aspect, and its literal interpretation could lead to the conclusion that, if there was no legitimate… Continue reading Tax advisor: The previous Corporate Tax Act already allowed the partial non-application of the FEAC regime.

Tax advisor: What personal changes must the taxpayer notify in the Income Tax Return?

For a taxpayer who wishes to apply deductions or reductions in the Income Tax Return, it is of vital importance to collect all the income obtained, but also all the personal data that may have changed in the last year. Personal changes to notify in the Personal Income Tax Return – Change of address: many… Continue reading Tax advisor: What personal changes must the taxpayer notify in the Income Tax Return?

Tax Advisor: Corporate Tax Deductions for R&D&I Projects

When an investment is made or expenses are incurred for the purpose of developing the economic activity of a company, there may be deductions in the amount of tax payable. That is why there are tax deductions in the Corporate Tax for R&D&I projects. The tax deduction can be seen as an indirect form of… Continue reading Tax Advisor: Corporate Tax Deductions for R&D&I Projects

Tax advisor: Inappropriateness in the modification of the accounting approved at the time by the Mercantile Register

The Superior Court of Justice of Andalusia ruled on November 22nd, 2022 in relation to deductible expenses in accounting. All as a result of a specific case: an appellant filed a certificate to rectify her request for rectification of her 2015 corporate income tax self-assessment to vary the profit and loss result. She attributed this… Continue reading Tax advisor: Inappropriateness in the modification of the accounting approved at the time by the Mercantile Register

Tax advisor: Rental housing and rehabilitation deductions in the 2022 Personal Income Tax return

Housing has always played a very important role in the Personal Income Tax return. Its deduction can be given due to the mortgage of the purchase, although this benefits less and less taxpayers and refers only to houses acquired before 2013. However, this year there are certain new features. Deductions for energy improvement works of… Continue reading Tax advisor: Rental housing and rehabilitation deductions in the 2022 Personal Income Tax return

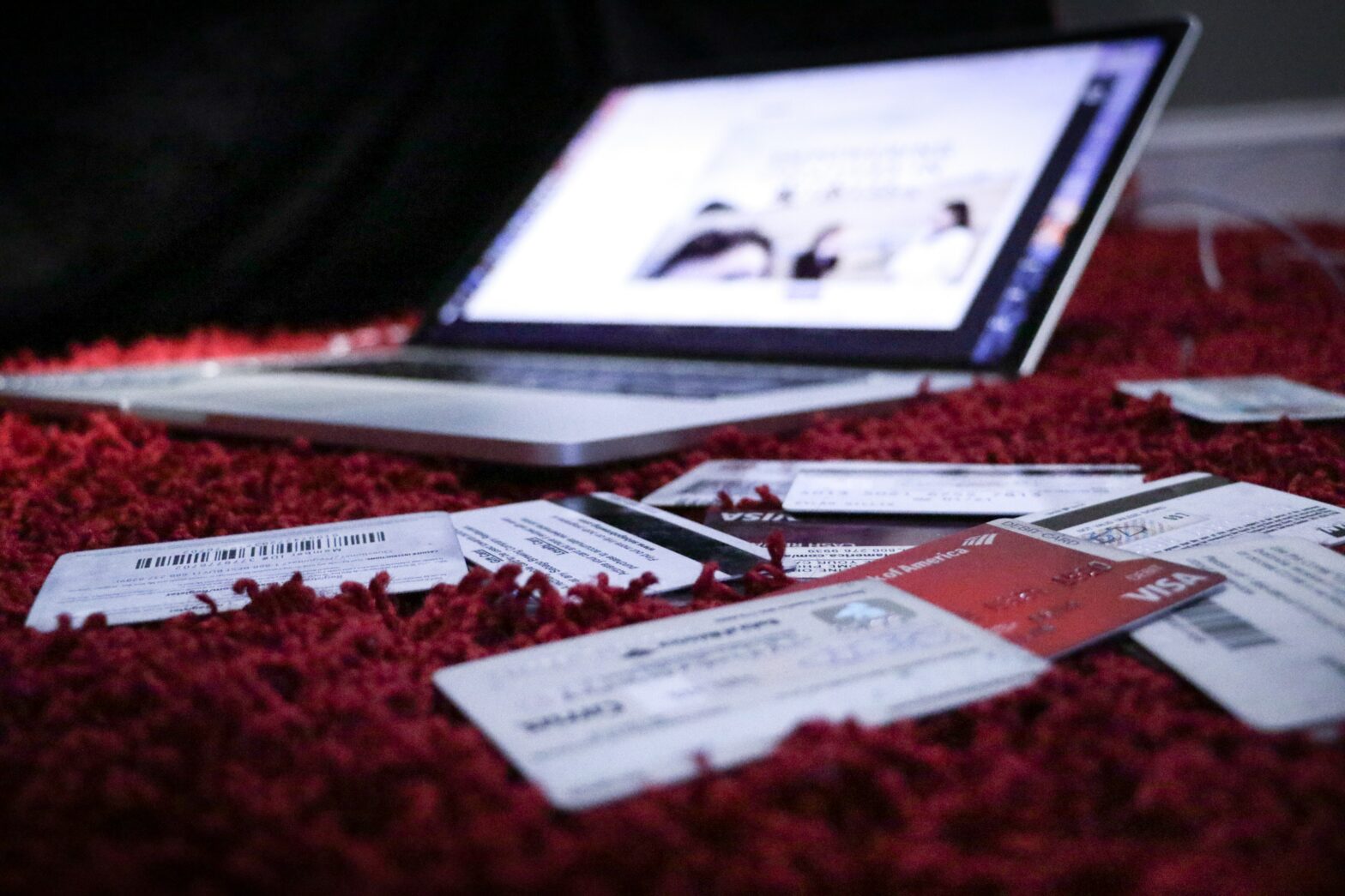

Tax Advisor: Flexibility of the Tax Agency in deferrals to facilitate the taxpayer’s liquidity

The BOE publishes Order HFP/311/2023, dated March 28th, with effect from April 15th, thus including two instructions: – Instruction 1/2023, of the Director of the Collection Department of the State Tax Agency, specifying the guarantees required to grant payment deferrals and to suspend administrative acts. – Instruction 2/2023, of the Director of the Collection Department… Continue reading Tax Advisor: Flexibility of the Tax Agency in deferrals to facilitate the taxpayer’s liquidity